Is Medicare Plan F Going Away?

You used to hear a lot of talk about Medicare supplement Plan F. It was the Cadillac of supplement plans up until a couple of years ago. However, you may have noticed the talk shifting more to Plan G these days. That has led many to believe that Medicare Plan F is going away.

Let’s talk about what you need to know regarding Medigap Plan F.

What is Medicare Supplement Plan F?

Medicare supplements are one way that Medicare beneficiaries can fill in the coverage gaps of Original Medicare (Parts A and B). As you may know, Medicare Part A and Part B do not pay for 100% of your healthcare costs, leading many beneficiaries to look for ways to supplement their coverage. Medicare supplements, also called Medigap plans, are one way to do that.

Medicare supplement Plan F offers first-dollar coverage. “First-dollar” coverage means that Plan F will pay all of your remaining costs, including your deductible.

Plan F coverage includes:

- Part A deductible

- Part A coinsurance and hospital costs, including 365 days of additional coverage

- Part A hospice coinsurance and copays

- Skilled nursing facility coinsurance

- First 3 pints of blood

- Part B deductible

- Part B coinsurance and copays

- Part B excess charges

- Foreign travel emergencies (up to plan limits)

It’s easy to see why Medicare beneficiaries looking to have virtually no out-of-pocket costs quickly enrolled in Medicare supplement Plan F.

Is Plan F going away?

If Plan F is so good, what’s all this talk about it going away?

The Medicare Access and CHIP Reauthorization Act was passed in 2015, which prohibited Medigap plans from providing first-dollar coverage. Since Plan F included that feature, it was no longer an option to any Medicare beneficiary who turned 65 on or after January 1, 2020, when MACRA went into effect.

Individuals already enrolled in Plan F are allowed to keep their coverage. And, anyone who delayed Medicare enrollment but still turned 65 before the deadline can still actively enroll in Plan F today. (We’ll discuss why that might not be the best option a little later.)

Alternatives to Plan F

Since Plan F isn’t available to newly-eligible beneficiaries, many of our clients ask what the next best option is. Our answer? Medicare supplement Plan G.

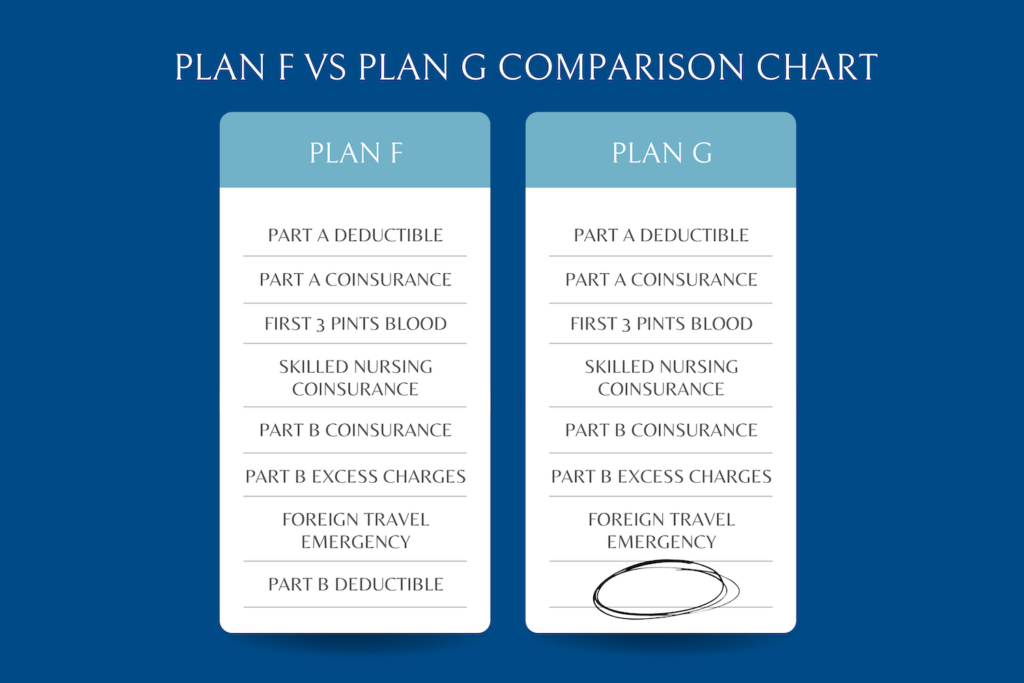

Plan G offers the exact same coverage as Plan F, with the exception of the Part B deductible. In 2023, that deductible is $226. Other than that benefit, the two plans are exactly the same.

Of course, there are other Medicare supplement plans to choose from. Plan N is also a great option but does require members to pay copays for doctor’s appointments and emergency room visits. You can read more about the difference between Plan G and Plan N here.

Why Plan G Might Be Better than Plan F

We know that Plan F has better coverage than Plan G, even if it is just slightly better. So if you are looking for the most coverage you can find, you may assume that it would be best to enroll in a Plan F. In our opinion, that’s probably not the case.

Here’s why.

Plan F has seen significant increases in monthly premiums over the last couple of years. The reason is that the pool of beneficiaries enrolled in Plan F is beginning to 1. decrease and 2. get older. Older individuals usually incur more medical costs than younger individuals. With fewer enrollees, there are fewer people to share in healthcare costs. Thus, premiums have been going up.

Medicare supplement premiums are based on two main factors: your age and location. Other factors include your gender, tobacco use, and the insurance company’s pricing method. We’re seeing a range in premium for Plan F between $140-$240 per month – some even higher than that. If you’re lucky enough to be on the low end, your total annual premium will be $1680.

Let’s compare that to the average monthly premium for Plan G, which ranges from $110-$210 per month. Again, assuming you’re on the low end, your annual premium will be $1320. The difference in annual premiums between the two plans is $360.

Remember that the Part B annual deductible is $226 in 2023. So the amount of money you would save with Plan G would more than pay for that deductible.

This is why we recommend Plan G over Plan F. If it is your first time enrolling in Medicare, you have guaranteed issue rights for Plan G, which means that an insurance company must issue you a policy, regardless of current or past health conditions.

If you currently have a Medicare plan and want to switch, you must answer health questions and pass medical underwriting before being granted access to the plan. This is a simple process that we will help you with.

If you are currently on Plan F and would like to find out if you can lower your premium by switching to Plan G, give our office a call!