Medicare Part D: What You Need to Know about Prescription Drug Plans

Medicare Part D is a prescription drug plan that you can enroll in if you have Medicare. It helps people with Medicare pay for prescription drugs. This blog article will briefly explain how Medicare prescription drug plans work, how they differ from plans offered by company employers, and how to avoid the Part D late enrollment penalty.

What is Part D Medicare?

Medicare’s prescription drug plan is referred to as Medicare Part D. It is the prescription drug plan for Medicare beneficiaries. This can be added to Original Medicare (Parts A and B) or as part of a Medicare Advantage Plan (Part C). As with the other parts of Medicare, members have a choice of plans and carriers for their Part D coverage.

What can I expect from my prescription drug coverage?

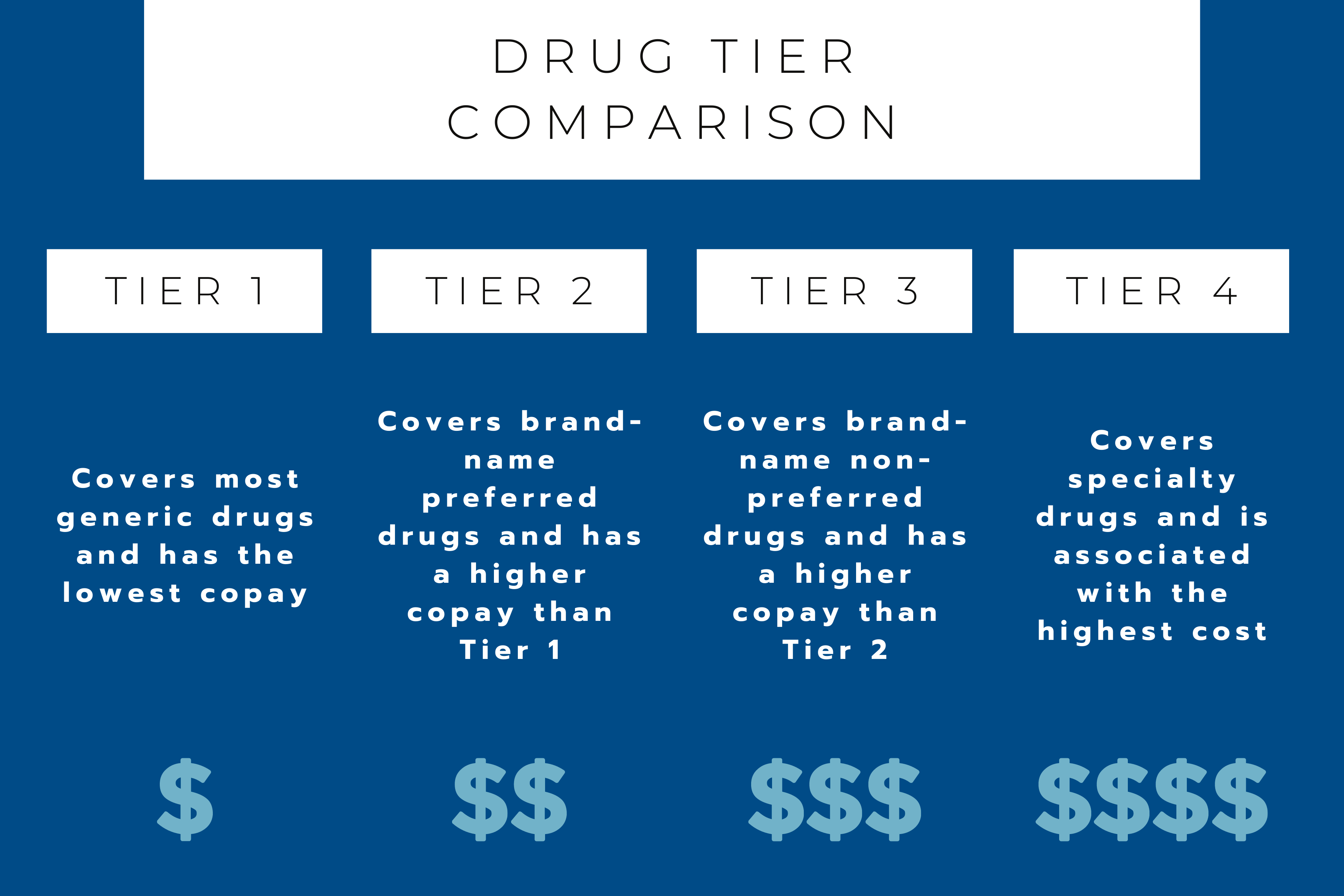

Each prescription drug plan will have its own formulary – the plan’s list of covered medications. These plans often place medications into different tiers on the formulary. Different tiers have different costs. (The lower the tier, the lower the cost.)

The Part D drug formulary is the list of drugs that are covered by a Part D plan. The Part D prescription drug formularies will have different tiers with different costs associated with them depending on how often you fill your prescriptions for certain medications.

Tiers are divided into four levels.

Tier One: This tier includes generic prescriptions and has the lowest copay.

Tier Two: This tier includes brand-name, preferred* prescription drugs and has a higher copay than those on tier one.

Tier Three: This tier includes brand-name non-preferred drugs and comes with a higher copay.

Tier Four: This tier is where you will find specialty medications. These come at the highest copay.

*Each state has its own list of preferred medications, the Preferred Drug List (PDL). If a medication is on this list, Part D will cover the medication without prior authorization. If the medication is not on the PDL in your state, your provider will need to get Medicare approval to cover the extra cost.

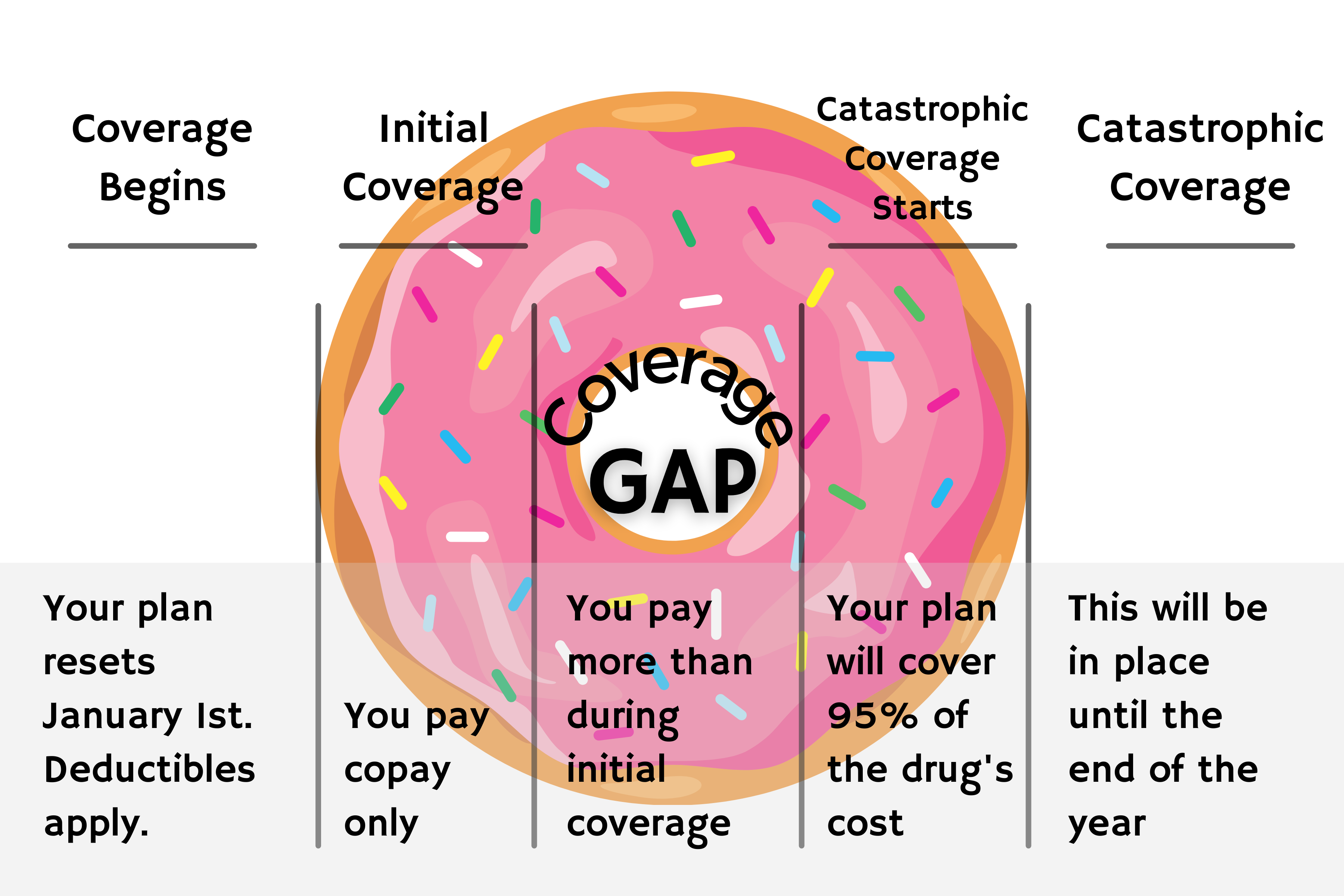

The Donut Hole

There is one key difference between Medicare Part D and insurance plans that are not associated with Medicare (like those through an employer).

That key difference is called the Donut Hole or Coverage Gap.

The Medicare Donut Hole is a gap inside every single Part D plan. Once the member and their plan have spent $4130 on prescription drugs, they will find themselves in the Donut Hole. This means that the same prescriptions that had been covered (or partially covered), will now cost more than they did prior to reaching the initial limit.

Once a member is in the Donut Hole, their out-of-pocket cost increases to 25% of the drug’s price.

There is a way to get out of the Donut Hole. Once a member has reached their out-of-pocket threshold, $6550 for 2021, catastrophic coverage applies. In this stage, they’ll pay no more than 5% of the cost for covered medications for the remainder of the year.

Part D Penalties

One last thing to note about Medicare Part D. If a member does not enroll when first eligible (or have creditable prescription drug coverage if they postpone enrollment) a 1% penalty applies. This penalty builds monthly and the member will pay this penalty for a lifetime. (Insert internal link for creditable coverage)

This Part D penalty is the most common of the Medicare penalties. It is especially overlooked by those members who do not currently take medications. Members should apply for coverage regardless of whether they are currently taking prescription drugs or not.

How do I choose the best Medicare prescription drug plan?

Working with an agent is the best way to choose the prescription drug plan that best fits the member’s needs and avoid any unnecessary penalties.

At Sunflower Insurance Solutions, we will compare every prescription drug plan on the market and make sure that you enroll in the plan that will give you the most benefits and lowest prescription drug costs.

If you are just turning 65 and are new to Medicare, you can sign up for Medicare drug coverage during your initial enrollment period. After that, you can review and make changes to your prescription drug plan during the Annual Election Period.

The AEP runs from October 15 to December 7 each year. If you make changes during this period, the changes will take effect on January 1.

If you would like to review your drug plan, give us a call! Our consultations are completely free, and there is no obligation to use our services.