How Income Impacts Your Medicare Premiums: 5 Tips to Decrease Cost

Not everyone pays the same premiums when it comes to Medicare Part B. The Social Security Administration – the office in charge of Medicare enrollment – will calculate your premium based on your previous income. In 2023, your Medicare premiums are based on your 2021 adjusted gross income (AGI).

If you can adjust your income prior to your Medicare enrollment year, great! This is the easiest way to make sure you are entitled to the standard premium. However, planning two years ahead is difficult. Let’s discuss how the premiums are calculated and how you may be able to appeal or reduce a higher Medicare Part B premium.

How are my Medicare premiums calculated?

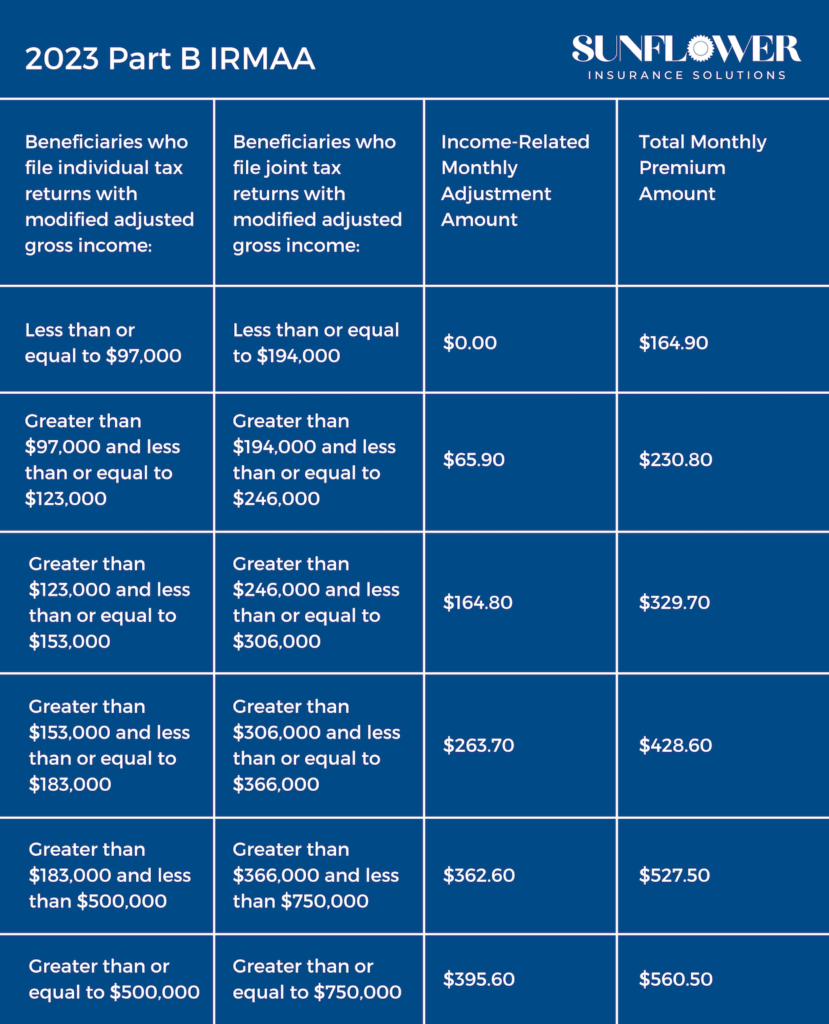

In 2023, the standard Medicare Part B premium is $164.90. This amount is what a majority of the population pays.

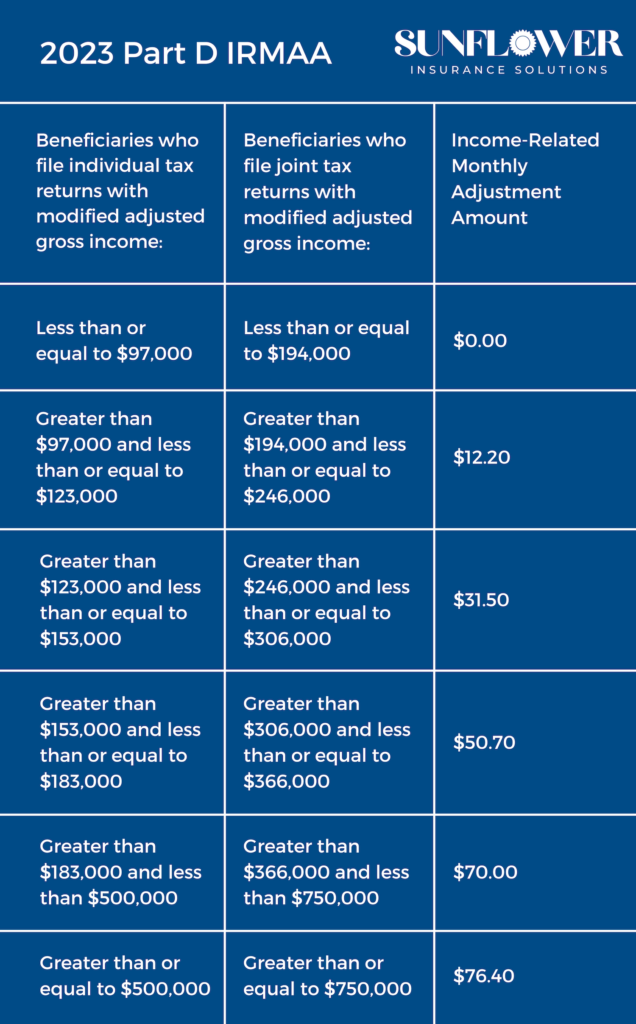

However, if your income crosses the “higher-income” threshold, you are considered to be a “higher-income beneficiary.” This means you will pay more than the standard premium for both Medicare Parts B and D. (These parts cover visits to your doctor and your prescription medications, respectively.)

The extra amount you pay is called the Income Related Monthly Adjustment Amount (IRMAA).

IRMAA for Part B in 2023

IRMAA for Part D in 2023

How can I get my premiums reduced?

Many people ask, “What if I’m making less money than I was two years ago? Why should I have to pay more for my premiums now?” This is a very common question. The good news is there are a handful of things you can do to reduce your monthly premiums.

File an appeal

If you have had a major life-changing event that has significantly impacted your income, an appeal is the best option to reduce your premiums. Events that qualify as “life-changing” are:

- Marriage

- Divorce

- Loss of job

- Loss of pension

- Loss of spouse

- Loss of property income

To file an appeal, you’ll need to fill out Form SSA-44 and provide a more recent tax return.

Apply for the Medicare Savings Program

There are four different Medicare Savings Programs. Each program has its own conditions and process for application. These programs offer varying types of savings depending on your qualifications.

Apply for Extra Help

The federal Extra Help program can help reduce your Part D premiums, deductibles, and copays, even if you do not qualify for any of the Medicare Savings Programs.

As with the savings programs, reductions vary by individual and depend on your current income and resources. You can apply for Extra Help here.

Use your HSA to pay your premium

If you have a Health Savings Account (HSA), you know the benefit – you saved tax-free money. If you use this money to pay your Medicare premium, you’ll also be spending the money tax-free. That means that you will be reducing your premium by what you would have paid in taxes.

Remember, once you are on Medicare, you can no longer contribute to a Health Savings Account. It’s time to start spending that money!

Deduct the premiums from your taxes

Not everyone can deduct Medicare premiums from their taxes. However, if you spent more than 10% (as of 2021) of your AGI on qualified medical expenses (which includes Medicare premiums), you can file an itemized deduction on your tax return. Many Medicare Supplement (Medigap) premiums are also qualified medical expenses.

Check with your accountant to see if this is an option for you.

These are five ways you can reduce the amount you are paying on Medicare premiums. If you have further questions, please contact your state’s Social Security office. You can also contact us at Sunflower Insurance Solutions.