5 Types of Medicare Advantage Plans Explained

So you’ve chosen to enroll in a Medicare Advantage Plan instead of a Medigap Plan. Great! However, you’re not quite done making decisions.

Since you have chosen a Medicare Advantage Plan over Medicare supplement insurance, you’ve bundled your Part A and Part B coverage all into one plan (Part C), and you won’t have the burden of choosing a dental, vision and hearing plan. You’ll also not have to enroll in a separate Part D prescription drug plan, as those are also (usually) included in Medicare Advantage Plans.

However, you will need to choose exactly what type of Medicare Advantage Plan will work well for you. To do that, you’ll need to know the difference between each type of plan.

There are different Medicare Advantage Plans to choose from with many different considerations to take into account. It is important to understand all of their differences and choose the plan that best fits your unique needs.

Hang in there! We’re going to break this decision down and make it as easy as possible.

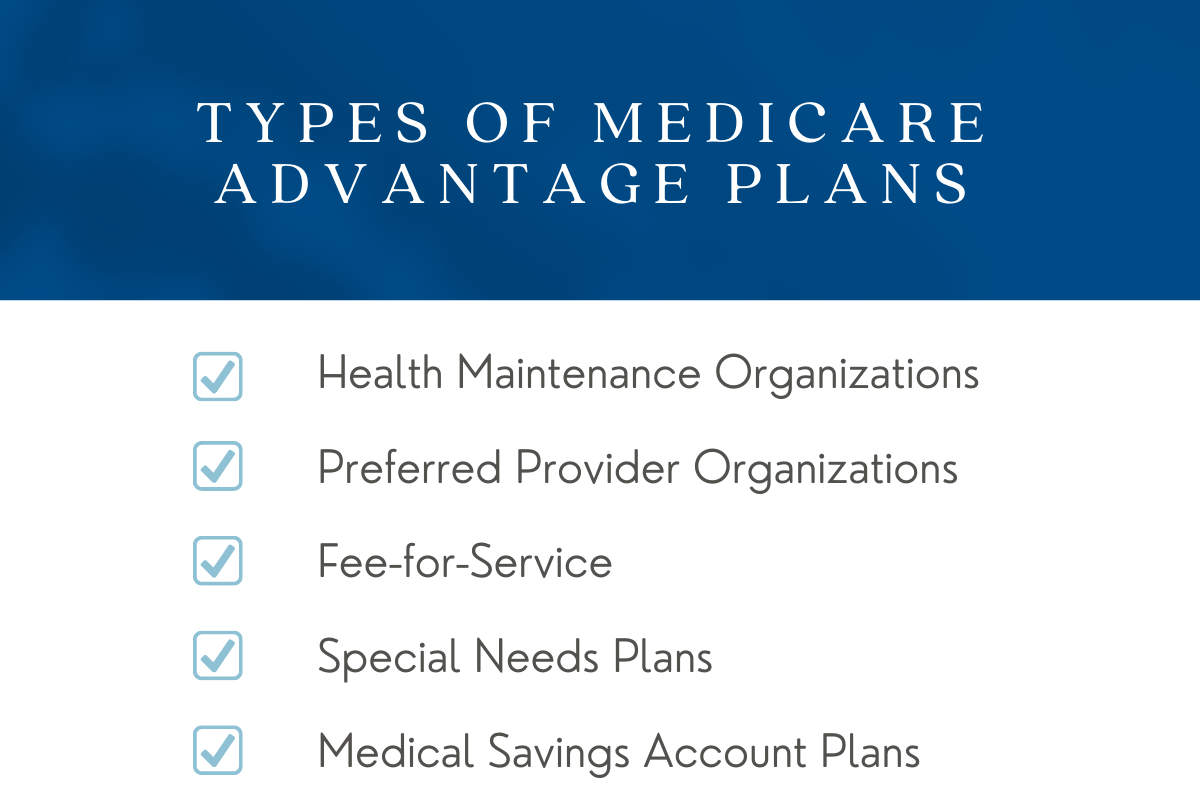

First, you need to know the five types of Medicare Advantage Plans available for you to choose from. This is where the big differences occur, so this first decision is key to choosing the perfect Medicare Advantage Plan. Let’s discuss the five types and the pros and cons of each.

Health Maintenance Organization Plans

Health Maintenance Organization plans are commonly referred to as HMOs. These plans are managed care health insurance plans, which means that they offer a lower cost while still offering quality care. They do this by enrolling a network of providers that have agreed to accept one payment for all of their services.

Overall, HMOs are usually a great option for individuals who are healthy and generally only require annual medical checkups.

Pros

Since providers in an HMO network have agreed to accept a lower fee for services, premiums, co-pays, and deductibles are lower for members compared to other types of insurance plans.

Cons

There are not as many HMO providers as there are PPO or private, fee-for-service providers. Even if your provider accepts Medicare, they may not accept an HMO plan.

Members who have a Medicare Advantage HMO plan must see a provider who is part of the HMO network. Going outside of this network will require that the member pay full, out-of-pocket fees for any services provided, except in the case of emergencies.

Specialist visits also require a referral from your primary care provider (PCP). Again, the specialist will need to be a member of the HMO network.

Preferred Provider Organization Plans

Preferred Provider Organization plans are also called PPOs. Like HMOs, these managed care plans create a network of providers that their members can choose from. Choosing a provider in a PPO network means that the member’s cost for services is decreased.

Pros

Unlike HMOs, these plans have more flexibility in that they allow members to see both in-network and out-of-network providers, though choosing an out-of-network provider can result in less payment from the carrier, meaning a higher out-of-pocket cost for the member.

Members with a Medicare Advantage PPO plan may see a specialist without a prior referral from their primary care physician.

Cons

Premiums and deductibles for PPO plans are generally higher than those for HMO plans.

Private Fee-for-Service Plans

These plans are also referred to as PFFSs. These Medicare Advantage Plans determine how much to pay providers who are contracted with private insurance companies who are also contracted with Medicare. These plans also determine how much the member pays for services, which can vary based on both the provider and the individual plan.

Pros

Members can see any Medicare-approved provider who accepts the plan’s payment terms.

No referrals to specialists are required, as the plan does not require the member to have a primary care physician.

Cons

Members may pay more if they choose to see a provider who does not accept the plan’s payment terms.

Providers can choose to quit accepting the plan’s terms, thereby increasing the member’s cost for services.

Special Needs Plans

Special Needs Plans, or SNPs, are tailored for individuals with certain diseases. This includes diseases like cancer, dementia, autoimmune diseases, among many others. It is also available for those living in nursing homes or who are eligible for both Medicare and Medicaid.

Pros

Special Needs Plans are not only tailored for each condition, but also for each individual. That makes these plans the most custom option.

These plans include a specific drug formulary based on the disease, allowing the member access to the medications they require.

Members are eligible to join at any time if they qualify.

Cons

These plans are not offered in all areas.

SNPs require referrals for specialists.

Members must use providers in their network.

Medical Savings Account Plans

You are probably familiar with HSAs – Health Savings Accounts. These accounts are limited to those with high-deductible health insurance policies. Those who qualify can contribute pre-tax dollars to a savings account that can later be used for qualified healthcare expenses.

A Medicare Medical Savings Account (MSA) is similar to an HSA but is only available to those with a high-deductible Medicare Advantage Plan. In an MSA, the plan deposits funds into the member’s savings account. These funds can be used for healthcare costs before meeting the plan’s deductible.

Pros

Funds from an MSA can be used for services not covered by Medicare.

Some Medicare MSAs offer dental, vision, and hearing benefits.

Cons

Medical Savings Accounts do not cover prescription drugs.

As the conditions state, MSAs require the member to have a high-deductible plan, which can create financial hardship.

Medicare Advantage Prescription Drug Plans

There is one other type of Medicare Advantage Plan that is important to discuss. That is the Medicare Advantage Prescription Drug Plans, or MAPDs. These plans include prescription drug coverage in addition to other medical services and hospital stays. They replace the Medicare Part D plans. This is a great option for members who would like all their coverage bundled into one plan.

As with other Medicare Advantage Plans, you will need to choose which type of MAPD to enroll in. You have a choice between HMO, PPO, PFFS, and SNPs. These plans come in a range of prices. The member cost will depend on location, income, and requested coverage.

Now that you understand the five types of plans offered by Medicare Advantage, you’ll need to consider how your needs match the conditions and requirements of each plan type.

Three Basic Considerations

Your Health

Consider how often you seek medical care. What are medical costs that you are already expecting? What kind of prescription drug costs do you have? However, also keep in mind that you need to plan for future care and your needs may change over time.

Provider Coverage

You will need to know what types of providers are in your area. This may be easier for those living in urban areas where the number of providers is much higher, but there can be a limited number of providers in rural settings. If you are choosing a plan that requires you to see in-network providers, you may want to find out if there are any such providers near you.

Budget

Which plan fits your budget? Remember, you will want to consider deductibles and copays in addition to the monthly premium.

That’s it! After you’ve taken all of your needs into consideration, see how each applies to the five types of Medicare Advantage Plans: HMP, PPO, PFFS, SNP, and MSA. Also consider your medication needs to decide if a Medicare Advantage Prescription Drug plan would be helpful.

Choosing the perfect Medicare Advantage Plan can be daunting. Begin by learning about the different types of plans and think about how each of them fits into your situation.

And of course, seek out your individual insurance agent so that all your questions are answered.